I. Introduction

Tax time in Australia comes with a strict calendar. So strict, missing a single date leads to costly penalties, lost deductions, or unnecessary stress. That’s why understanding key tax deadlines isn’t just good practice; it’s necessary for compliance and peace of mind.

For many individuals, businesses, and accounting professionals, the tax time is overwhelming, especially with deadlines shifting slightly from year to year. To avoid stress, we created this guide to break down the most important tax time dates and links out to year-specific resources. If in doubt, check it out.

II. Overview of Recurring Tax Time Dates in Australia

While specific dates can shift slightly due to weekends or holidays, several key recurring tax deadlines form the backbone of the tax calendar. Being aware of these general tax time cycles is fundamental for planning and compliance.

| Tax Season Guide Dates in ANZ Region | |

|---|---|

| July 1 | Receipt of W-2 and 1099 forms |

| October 31 | Federal income tax filing deadline (adjustments apply if the date falls on a holiday or a weekend) |

| May 15 (2026) | Due Date for lodging tax returns for individuals and small businesses that use a registered tax agent |

| October 28 February 28 April 28 July 29 |

Pay-As-You-Go installment due dates, however these dates vary and may change if these days fall on a weekend or during public holidays. |

III. Tax Season Dates, Guides, & Highlights (2024 - Present)

2025 Tax Season Guide Dates

The 2025 tax time brought with it a new set of important dates and updates to tax laws that require careful attention. We listed this year’s tax time deadlines and other resources for the 2025 tax time to serve as your guide for understanding key dates, preparing new regulations, and keeping up with changes to tax processes.

2024 Tax Season Trends and Deadlines

The 2024 tax time presented its own set of critical deadlines and important considerations for both individual and business filers across Australia. Our comprehensive guide mapped out all the important dates and deadlines per month, to help you get a better understanding of when to file and what to prepare.

It also covered some trends and other notable changes that impacted the filing process for the year. For a complete breakdown of all key dates and detailed information, here are some of our important resources:

IV. Tools and Resources for Tax Season

Tax time relies heavily on your ability to find and use the right tools and resources. From software that simplifies filing to official government portals and other helpful organisational strategies, our list of resources allows you to streamline your tax preparation process:

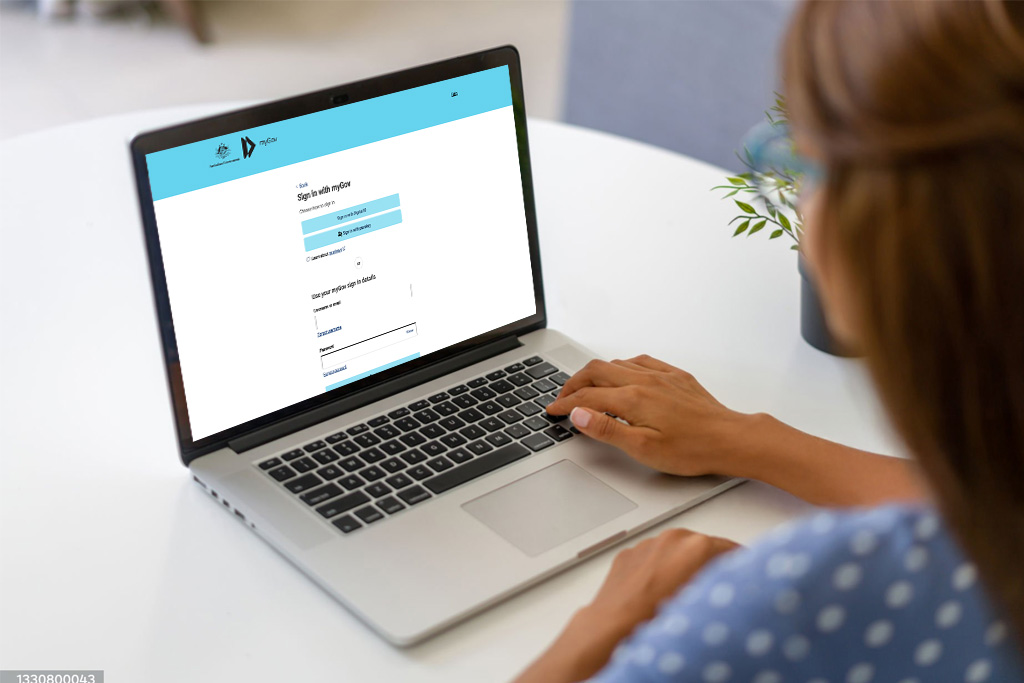

Tax Preparation Software – Utilising dedicated tax preparation software simplifies the filing process, so you are guided through each step to ensure accuracy.

Popular options like MyGov and bookkeeping software offer user-friendly interfaces, cater to different filing needs, from simple individual returns to more complex business taxes. These software also provide options for both Australian tax filings and offers expert assistance for more complex situations.

Financial Planning Apps – Integrating financial planning apps into your routine year-round makes the tax time smoother. Many apps allow you to categorise expenses, track income, and link bank accounts. This shows you a clear financial overview that’s especially useful when you’re preparing your taxes.

By maintaining financial records throughout the year, either by digitally scanning and saving documents or keeping well-organised physical files, you easily find all the necessary data for your tax returns.

Official Tax Authority Resources – Direct access to official resources from tax authorities provides more accurate information and tracking. For taxpayers in Australia, the Australian Taxation Office (ATO) provides free resources. Key among these is Tax Return Progress tool, which allows you to track the status of your federal tax refund.

The ATO website also offers publications, forms, and a frequently asked questions section to help you understand specific tax laws and requirements.

Pro tip: Utilise effective document organisation. Beyond tools, keeping tax documents organised throughout the year through dedicated digital folders or well-structured physical files allows for more efficient and accurate filing. Sorting out your expenses and holding onto those yearly records means you’ll have all the info you need right at your fingertips when taxes roll around.

This disciplined approach to organising documents allows you as an individual taxpayer to make sure you’re following all the rules and getting the most money back. If you’re an accountant, on the other hand, it means you can serve clients faster, and with more efficiency.

V. Conclusion

Understanding and managing tax time dates is essential for financial health, both for individuals and businesses. The stress and penalties from missed deadlines can be easily avoided with early preparation and a good understanding of the tax calendar.

We created this guide to provide an overview of important tax dates and emphasise the need for timely filing. Explore our detailed, year-specific guides for the latest information on tax updates, challenges, and deadlines. These resources will give you the insights you need to navigate tax time effectively.

Struggling with capacity this tax time? Book a chat to discuss offshore solutions, so we can help your firm take on more clients without the extra overhead.